Recent data from HTA shows how the gardening category has recovered from the early garden centre closures of April and May. Sales of all gardening products are now 2% ahead of the same time last year, despite 8 weeks of closure in the first lockdown.

So, it seems reasonable to go forward into 2021 with a justifiable level of optimism. Data also suggests that there is anything up to 3 million extra consumers engaged with the gardening category. They should represent a huge opportunity for further growth in 2021.

It’s interesting to compare the gardening category with other retail and product categories. Kantar report that total shopping trips are down by 10% in 2020 whilst average basket size has grown by 26%. Anecdotal reports from garden centres suggest footfall has been down rather more than 10%, but average basket sizes have grown much more substantially by 50 – 80%. So, more good news for the gardening category?

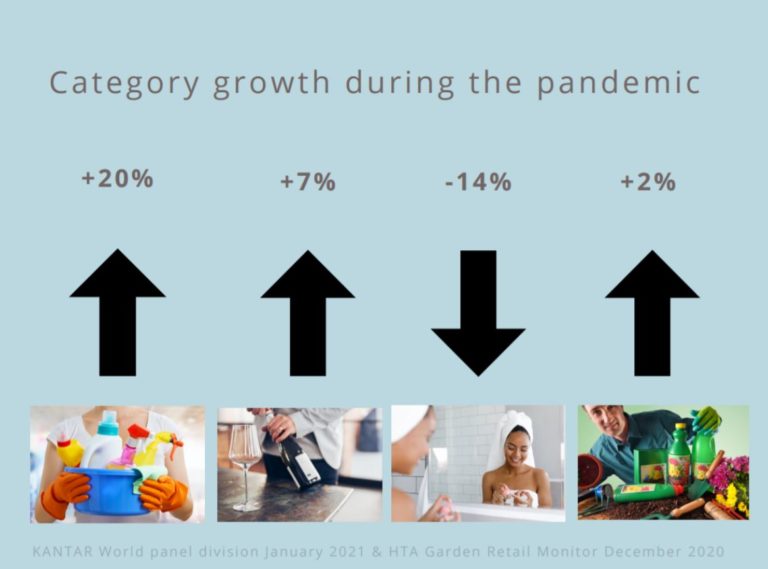

Digging a bit deeper into the FMCG data reveals rather more startling comparisons. Two out of three product categories have seen faster growth during the pandemic. Bleach, adult incontinence wear and air fresheners all enjoyed +10% or more difference in growth. Among food and drink, the winners include canned foods, wine and cider (which may partly explain the adult incontinence trend). Personal care and beauty has seen significant negative growth.

Perhaps it’s not surprising that the fastest growing brands in 2020 were Dettol (+52%) and Harpic (+29%) driven by additional hygiene routines. However, Kantar predict that as lockdowns are lifted, shopping behaviour is unlikely to return to pre-Covid ‘normal’ because consumers have become used to less frequent shopping trips and a higher reliance on-line. As the ‘stay at home’ effect wears off they expect overall FMCG demand to return to pre-Covid levels.

That means that health and beauty is expected to rebound with growth of 6% whilst food and beverages will slide back by 2% and homecare levels off.

Without a robust forecast for gardening, and assuming Kantar are correct about consumer’s return to ‘a new normal’, we might see the gardening category soften next Spring as people focus on holidays, socializing and eating out.

So, back to worrying more about the weather – quite a comforting prospect and definitely more like our ‘normal’.